Table of Content

Therefore, it is necessary that you realize precisely how much cash you want to get through your monetary emergency. By only taking out the money you completely want, you may be able to be extra financially secure in the long run. I was informed I had no choice but to buy an annuity with The protected rights which amount to approximately £166.00 per thirty days. I chose not to be pressured into an annuity and haven’t accepted any monies from the provider, Standard Life, whom I actually have found extremely tough to deal.

Cashing out part of your annuity can imply having money on hand for giant expenses. A withdrawal penalty is a penalty or additional cost incurred by an individual from an account where withdrawals are controlled based on a timeline. A 457 plan is a tax-advantaged retirement financial savings account available to many employees of governments and nonprofit organizations.

Can You Inherit A Lottery Annuity?

Usually these fees are within the first 3-10 years of buying your annuity. The answer to this query depends on a few components, including the kind of annuity you may have and how lengthy you’ve been paying into it. Generally talking, you will owe taxes on any cash you withdraw from your annuity. However, there may be some exceptions depending on your particular situation.

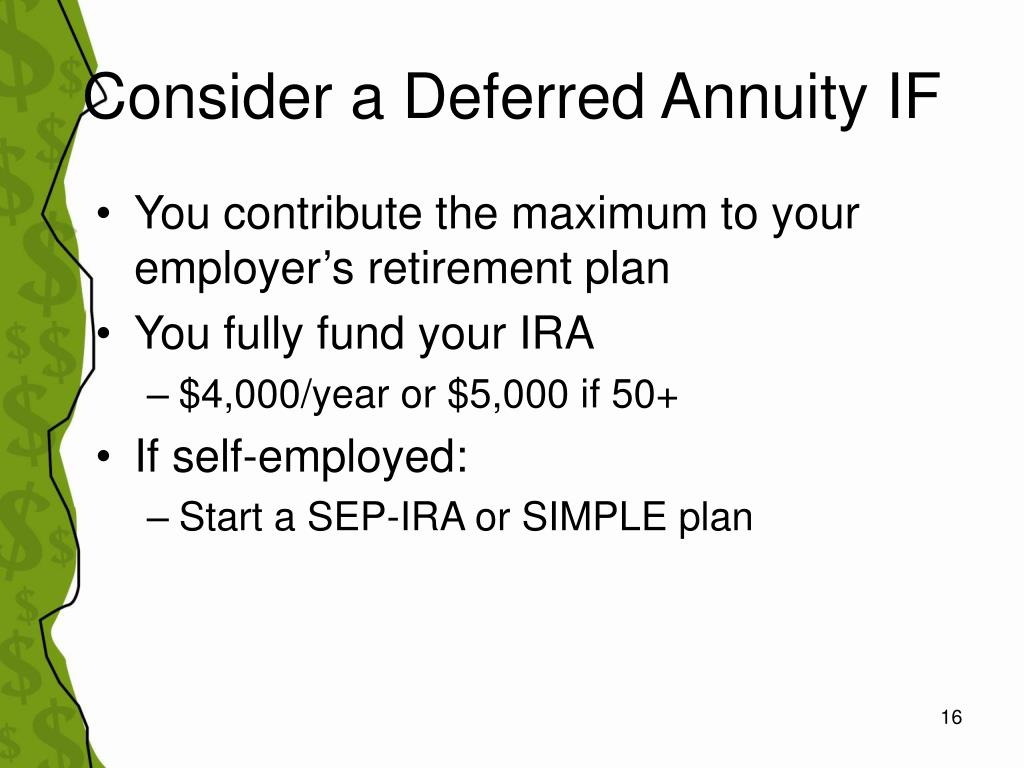

Unlike deferred annuities, most instant annuities do not provide an possibility for small-sum early withdrawals or partial sales. You will likely have the opportunity, however, to sell the entire quick annuity for a lump-sum. However, if you're in a monetary emergency and require quick money, you might need to cash out an annuity early. While there could additionally be hefty charges concerned, notably in case your annuity is held inside a retirement account like an IRA or 401k, it's possible to get quick money out of your annuity funding. 12 years ago I was able to take an Income Withdrawal account when the federal government increase the minimal pension pot from 50K to 100k.

Annuities Guides

Preparing for your retirement is a crucial job and, since Pension Freedoms was launched in 2015, the extra selection now out there may end in making a call harder. The current U.S. median account stability is only sufficient to buy an SPIA with a month-to-month payment that is about half the average monthly Social Security benefit. The annuity wouldn't embody the extra features of inflation protection and survivor advantages. Term certain annuity and dies after 6 years, the month-to-month funds continue to the designated beneficiary for four years.

Rather than protracted wrangling, they might supply to purchase the annuity again – this could even rely upon whether or not Regulators threaten motion on the idea of the FCA Thematic Review. Tanza Loudenback, CFP® is SmartAsset’s monetary planning columnist, and answers reader questions on private finance topics. As you probably can see, Uncle Sam takes an enormous chunk out of your haul before you can even choose which index fund you wish to invest in.

What Is The Greatest Way To Cash Out My Annuity?

Depending on how a lot money you require, these installments might be adequate for your wants. There are 12 references cited on this article, which can be found at the bottom of the web page. Enhanced annuities work on this basis and can secure you up to 30% more earnings. They are usually shown as how a lot cash you may get per year for every £100,000 you pay in.

Fixed earnings, corresponding to Social Security, a pension, or an annuity offers you with peace of thoughts that a certain amount of money will hit your checking account each month. You may be topic to a surrender charge when you cash out early with some annuities. The Annuity Expert is anonline insurance coverage company servicing consumers throughout the United States.

Spouse Vs Non-spouse Beneficiaries

Withdrawing cash early from an annuity brings with it a danger of charges and will considerably harm the long-term potential of your funding. Consider very rigorously whether or not you're in a real financial emergency earlier than taking steps to promote an annuity, and make positive to use early withdrawal options only as a last resort. Some annuity contracts allow you to pull out some funds annually with out incurring a surrender cost. If that possibility is on the market to you, that could presumably be more economical than taking a lump-sum early withdrawal since your cash needs, it appears, aren’t quick. Depending on the size of the inheritance, it might make sense to work with a monetary advisor. A good advisor can help you establish a holistic plan that reflects consideration in your current financial position and future retirement needs.

It’s essential to notice that not every contract lets you make free withdrawals. Review your contract and converse with somebody out of your insurance coverage company in case you have questions. Some annuity contracts have surrender charge waivers for particular situations, corresponding to nursing house confinement or terminal illness. If you're taking cash out of an annuity, you may face a penalty or a surrender charge, also referred to as a withdrawal, or give up cost. You may face a penalty or a give up payment, also identified as a withdrawal, or surrender cost when you take money out of an annuity.

Can Any Kind Of Annuity Pension Be Cashed In?

Because almost all U.S. employees are coated by the program, Social Security is prepared to pool mortality risk—the uncertainty about how long one will live—over a big and heterogeneous population. The funding within the contract is the mixture premiums or other consideration paid for the annuity minus quantities paid out that were excluded from income (and/or any dividends received). The acquire is odd earnings, not capital acquire, and thus cannot be netted in opposition to capital losses.

Pensions Minister, Steve Webb, has called for an extension of the unconventional overhaul of pensions to incorporate current pensioners who could have purchased annuities however aren't pleased with their deal. In precept, I suppose this is in a position to be extremely well-liked and is a chance to guarantee that those that have missed out on the forthcoming pensions flexibility have some chance to be included in future. The offers that seem in this desk are from partnerships from which Investopedia receives compensation.

A beneficiary is the one that receives the demise benefits, normally the remaining contract worth or the quantity of premiums minus any withdrawals, upon the annuitant’s death. It’s important to make clear that an annuity owner and an annuitant usually are not always the same individual. Insurance companies refer to the annuity purchaser as its owner. The proprietor creates the annuity phrases with the insurance company, designates beneficiaries, can promote the annuity and has automated rights over the agreement.

No comments:

Post a Comment